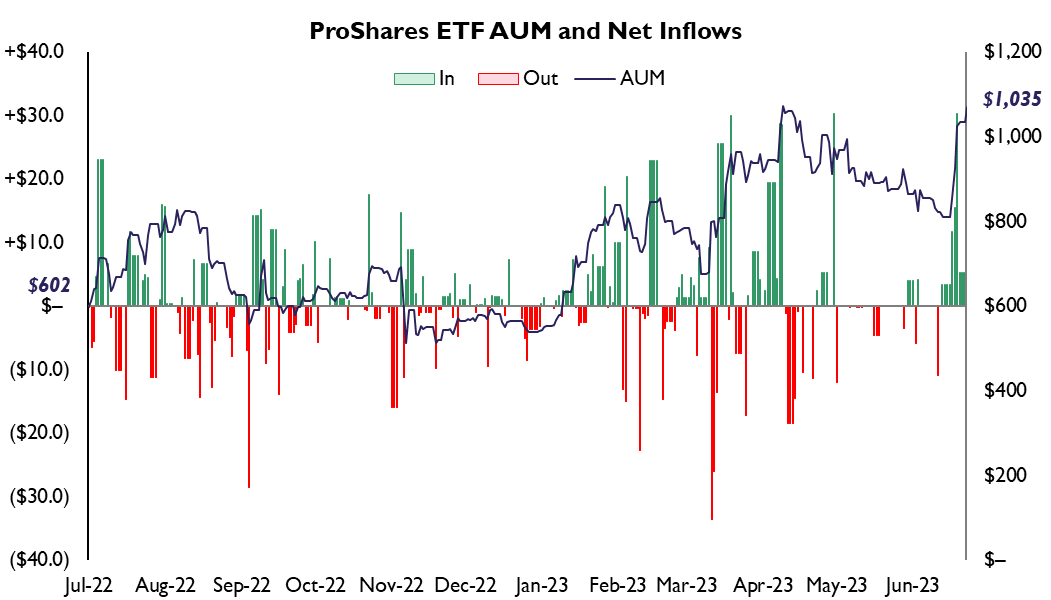

The crypto market rally kicked off by BlackRock's surprise spot bitcoin exchange-trade fund filing has brought tens of millions of new inflows into a futures-based fund managed by ProShares.

ProShare's BITO fund saw an additional $14.9 million of inflows on June 29 and $11.9 million of inflows on July 3, bringing its total assets under management to $1.04 billion, according to ETF.com. By way of comparison, the fund's AuM on June 15 — the day on which BlackRock's ETF application was submitted — stood at $822 million.

ProShare's futures-based fund made its market debut in late 2021. There's a long list of issuers vying to launch a spot bitcoin ETF, which could bring further legitimacy to bitcoin as well as its underpinning market structure. The U.S. Securities and Exchange Commission has historically denied such a product because of a lack of proper surveillance across spot trading venues.

As noted by European asset manager CoinShares, the crypto fund space has benefited from the excitement around a spot bitcoin ETF coming to market. Weekly inflows into crypto asset management products were strong for the second week in a row, with CoinShares reporting $125 million coming into the industry last week. That brought total inflows into such products to $334 million over the past two weeks, according to the European asset manager.

Earn Coin

Earn Coin Mining

Mining

Play Games

Play Games

Spin Wheel

Spin Wheel Miner

Miner Play & Win

Play & Win